Comprehensive protection and financial security for VPS members, regulated under SECP’s Voluntary Pension System Rules, 2005.

Payout equals VPS balance, up to Rs 12 million.

Accidental death within 90 days, payout up to Rs 12 million.

Permanent disability within 90 days, payout up to Rs 12 million.

Permanent disability due to illness, payout up to Rs 12 million.

Covers care & surgeries, up to Rs 1 million.

Serving more than 100 Million Lives in Health Care

State Life Insurance Corporation of Pakistan (SLIC) is the country's largest financial security institution, managing over PKR 2.1 trillion in assets and safeguarding futures for more than 50 years. Our Voluntary Pension Scheme (VPS) is designed to deliver what matters most: stability, efficiency, and returns.

Decades of experience across a range of sectors.

Pakistan's most extensive network of benefits.

Competitive returns for your retirement.

Over 50 years of trust and service.

Proven track record of consistent growth.

Serving millions with unmatched coverage.

Plan today for a financially independent tomorrow.

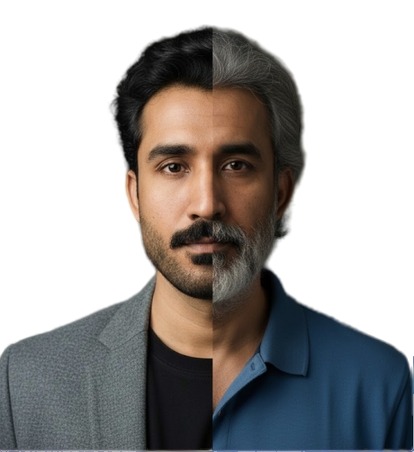

Explore flexible pension options designed to give you peace of mind and long-term security.

Compare maximum investment and tax savings for Salaried and Non‑Salaried individuals under the VPS scheme.

| Monthly Income | Annual Income | Annual Income Tax | Effective Tax Rate | Maximum Investment | Maximum Tax Saving |

|---|---|---|---|---|---|

| 100,000 | 1,200,000 | 6,000 | 0.5% | 240,000 | 1,200 |

| 200,000 | 2,400,000 | 66,000 | 2.8% | 480,000 | 13,200 |

| 300,000 | 3,600,000 | 306,000 | 8.5% | 720,000 | 61,200 |

| 400,000 | 4,800,000 | 861,000 | 17.9% | 960,000 | 172,200 |

| 500,000 | 6,000,000 | 1,281,000 | 21.4% | 1,200,000 | 256,200 |

| 600,000 | 7,200,000 | 1,731,000 | 24.0% | 1,440,000 | 345,600 |

| 700,000 | 8,400,000 | 2,211,000 | 26.3% | 1,680,000 | 442,200 |

| 800,000 | 9,600,000 | 2,541,000 | 26.5% | 1,920,000 | 508,200 |

| 900,000 | 10,800,000 | 2,961,000 | 27.4% | 2,160,000 | 592,200 |

| 1,000,000 | 12,000,000 | 3,381,000 | 28.2% | 2,400,000 | 676,200 |

| 1,100,000 | 13,200,000 | 3,801,000 | 28.8% | 2,640,000 | 760,200 |

| 1,200,000 | 14,400,000 | 4,221,000 | 29.3% | 2,880,000 | 844,200 |

| Monthly Income | Annual Income | Annual Income Tax | Effective Tax Rate | Maximum Investment | Maximum Tax Saving |

|---|---|---|---|---|---|

| 100,000 | 1,200,000 | 90,000 | 7.5% | 240,000 | 18,000 |

| 200,000 | 2,400,000 | 410,000 | 17.1% | 480,000 | 82,000 |

| 300,000 | 3,600,000 | 810,000 | 22.5% | 720,000 | 162,000 |

| 400,000 | 4,800,000 | 1,290,000 | 26.9% | 960,000 | 258,000 |

| 500,000 | 6,000,000 | 1,830,000 | 30.5% | 1,200,000 | 366,000 |

| 600,000 | 7,200,000 | 2,370,000 | 32.9% | 1,440,000 | 474,000 |

| 700,000 | 8,400,000 | 2,910,000 | 34.6% | 1,680,000 | 582,000 |

| 800,000 | 9,600,000 | 3,450,000 | 35.9% | 1,920,000 | 690,000 |

| 900,000 | 10,800,000 | 3,990,000 | 36.9% | 2,160,000 | 798,000 |

| 1,000,000 | 12,000,000 | 4,530,000 | 37.8% | 2,400,000 | 906,000 |

| 1,100,000 | 13,200,000 | 5,070,000 | 38.4% | 2,640,000 | 1,014,000 |

| 1,200,000 | 14,400,000 | 5,610,000 | 39.0% | 2,880,000 | 1,122,000 |